Whether you’re looking for integration with ERP systems like NetSuite or QuickBooks, or a comprehensive AP software solution to optimize your finance team’s workflow, these tools help automate your payable process and ensure seamless accounts payable management. Find the right AP automation solution to meet your business needs and improve efficiency.

Automate document processing with TurboDoc

Recognize invoices, contracts, and forms in seconds. No manual work or errors.

Try for free!

What is Accounts Payable Automation?

Accounts payable (AP) automation is a type of technology that streamlines and enhances traditional AP operations. The software automates several key functions such as capturing supplier name, total amount, taxes, due date, supplier payment details, invoice number, invoice date and others and routing them for approval. This proactive approach reduces errors and increases efficiency for smoother financial management.

Benefits of Accounts Payable Automation

Accounts payable automation offers significant benefits for businesses, especially small businesses. By using the best accounts payable software solutions, companies can streamline their payable process, reduce manual tasks, and increase accuracy. End-to-end AP automation simplifies invoice processing and integrates seamlessly with major accounting software like QuickBooks.

Cloud-based solutions allow businesses to manage their accounts payable from anywhere, improving efficiency and cash flow. With the right accounts payable software, companies can reduce errors, accelerate payments, and ensure timely financial operations. In 2025, top AP software solutions are designed to automate and optimize workflows, making it easier for businesses to stay on top of payments and maintain strong vendor relationships.

How to Choose the Right Accounts Payable Automation Solution

-

Pricing and Value: Evaluate all costs involved, including setup fees and ongoing subscription charges and ensure the pricing fits your budget and offers good value for the features provided.

-

Integration Options: The solution should integrate with your existing ERP/CRM/SRM or accounting systems, enabling a truly seamless invoice processing workflow from start to finish. Plus, mail integration can help with a smooth transition to automated invoice processing.

-

Security and Compliance: Ensure the solution has robust security features to protect sensitive financial data. Your confidential data should be handled securely, protecting against unauthorized access.

-

Scalability and Customization: Look for a solution that can scale to handle growing invoice volumes and can adapt to your unique business processes. The ability to configure workflows, approval hierarchies, and reporting is key. Also, flexible pricing is important to ensure flexibility and efficiency at every stage.

-

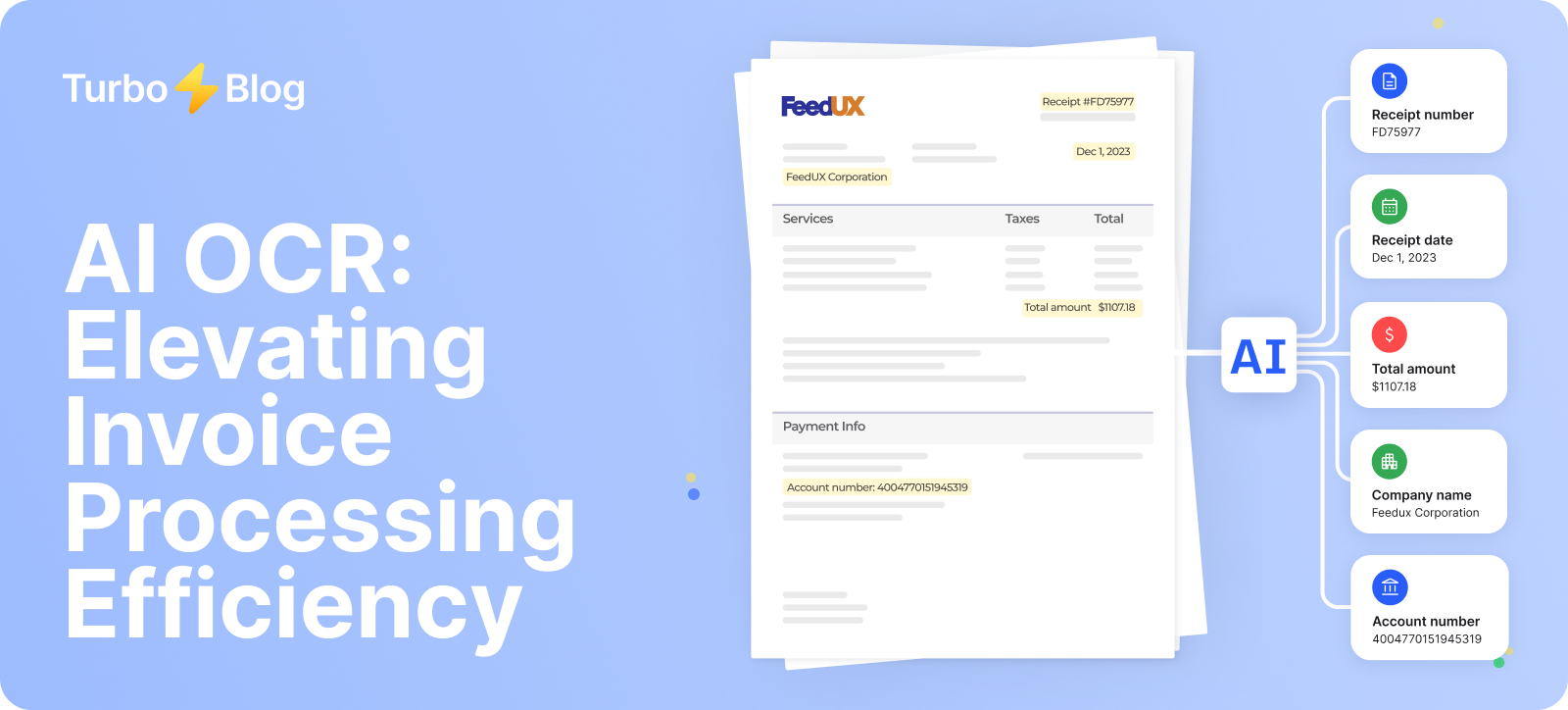

Data Extraction Accuracy: Modern Optical Character Recognition, combined with machine learning, can work with more complex invoices or low-quality images. The software is capable of successfully extracting data from invoices, such as vendor name, invoice number, dates, line items, and totals.

Automate document processing with TurboDoc

Recognize invoices, contracts, and forms in seconds. No manual work or errors.

Try for free!

Top AP Software Solutions for Small Businesses

- TurboDoc

- Basware AP Automation

- Celonis Process Intelligence Platform

- Vroozi SpendTech

- Coupa

- Nanonets

- Concur Invoice

- Bill.com

- OpenText Vendor Invoice Management for SAP Solutions

- Airbase

9 Best Accounts Payable Software Solutions for 2025

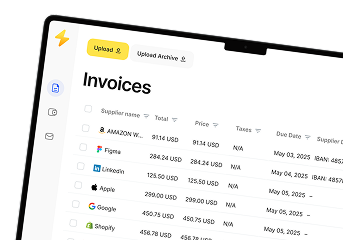

1. TurboDoc

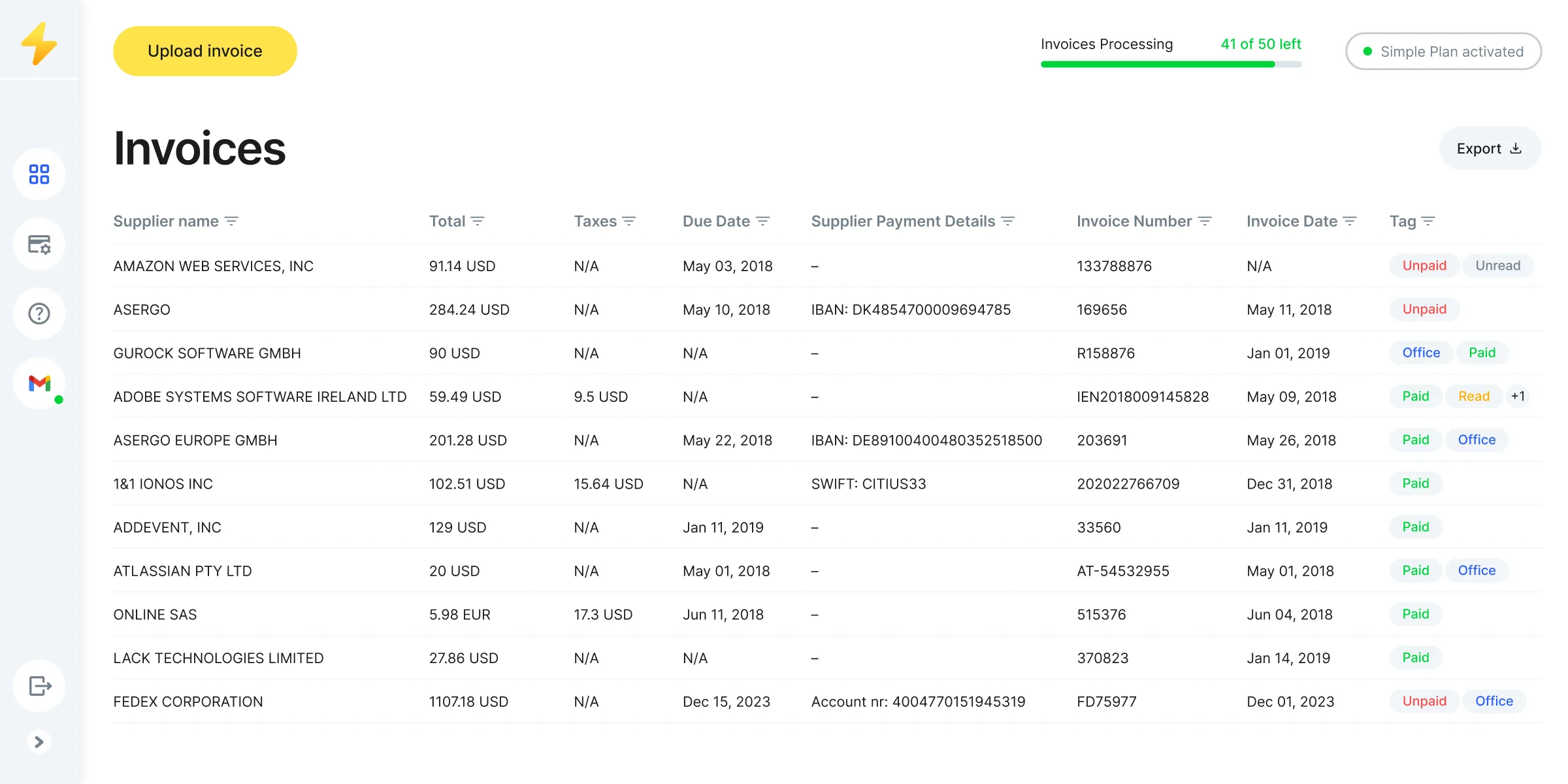

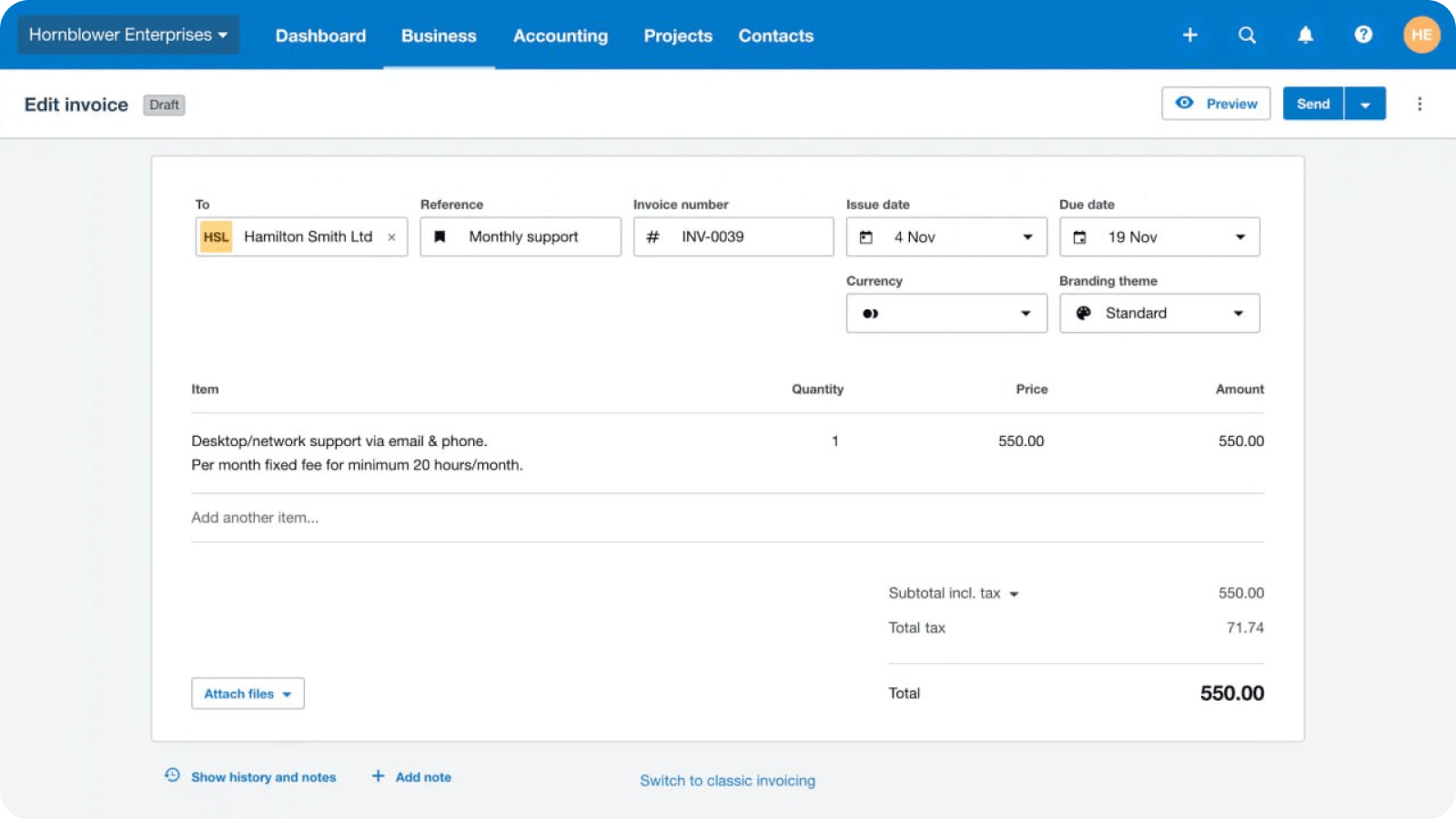

TurboDoc is an optical character recognition tool offering automated invoice and receipt processing using AI. By using our tool, you can save time and focus more on other areas critical to the business. TurboDoc is powered by an advanced AI model trained on a large corpus of documents, ensuring high accuracy.

TurboDoc’s dashboard: invoices are being imported automatically from Gmail mailbox

Benefits of choosing TurboDoc for AP automation

TurboDoc simplifies AP automation with its rapid and precise data extraction. Invoices come in all kinds of different formats and processing each invoice requires full-time departments. By integrating our solution, businesses can reclaim valuable time and eliminate the risks associated with manual processing errors.

Easily integrate TurboDoc into your existing workflow through Gmail to automate accounts payable

TurboDoc can provide a smooth transition to automated AP processing through Gmail integration, delivering scalability and adaptability as your business evolves. We are currently working on compatibility options using accounting software APIs. Our product will seamlessly integrate into your current accounting processes and ERP/CRM/SRM systems. TurboDoc will boost accuracy, efficiency, and productivity, making it a valuable tool for businesses looking to optimize their financial operations.

TurboDoc prioritizes data security and compliance

Our platform protects your data from unauthorized access or breaches. You can trust that your confidential information is handled with the utmost care and in compliance with relevant regulations by choosing TurboDoc. You can find more details about it in our Privacy Policy section.

Pricing

- Simple – $6/month

- Pro – $30/month

- Self-hosting – Ad-hoc

Automate document processing with TurboDoc

Recognize invoices, contracts, and forms in seconds. No manual work or errors.

Try for free!

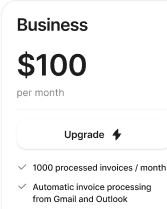

2. Xero

Xero is a cloud-based accounting software that offers robust AP automation capabilities, including invoice data capture, approval workflows, and seamless integration with payment systems. Users can track their financial metrics, perform cash flow analysis, file GST returns, backup their original documents electronically, and do much more when it comes to running their business using its various tools.

Xero dashboard: invoice editing feature

Pros

- Simplistic UI provides a clear financial view

- Automated daily bank feeds

- Interactive credit control to manage sales invoices

Cons

- Limited expense claims, projects, as-well-as multi-currency support

- It does not offer a built-in ‘Debtor Chasing’ function

- Some features are complicated to understand and require experience

Pricing

- Early – $11 per month

- Growing – $32 per month

- Established – $62 per month

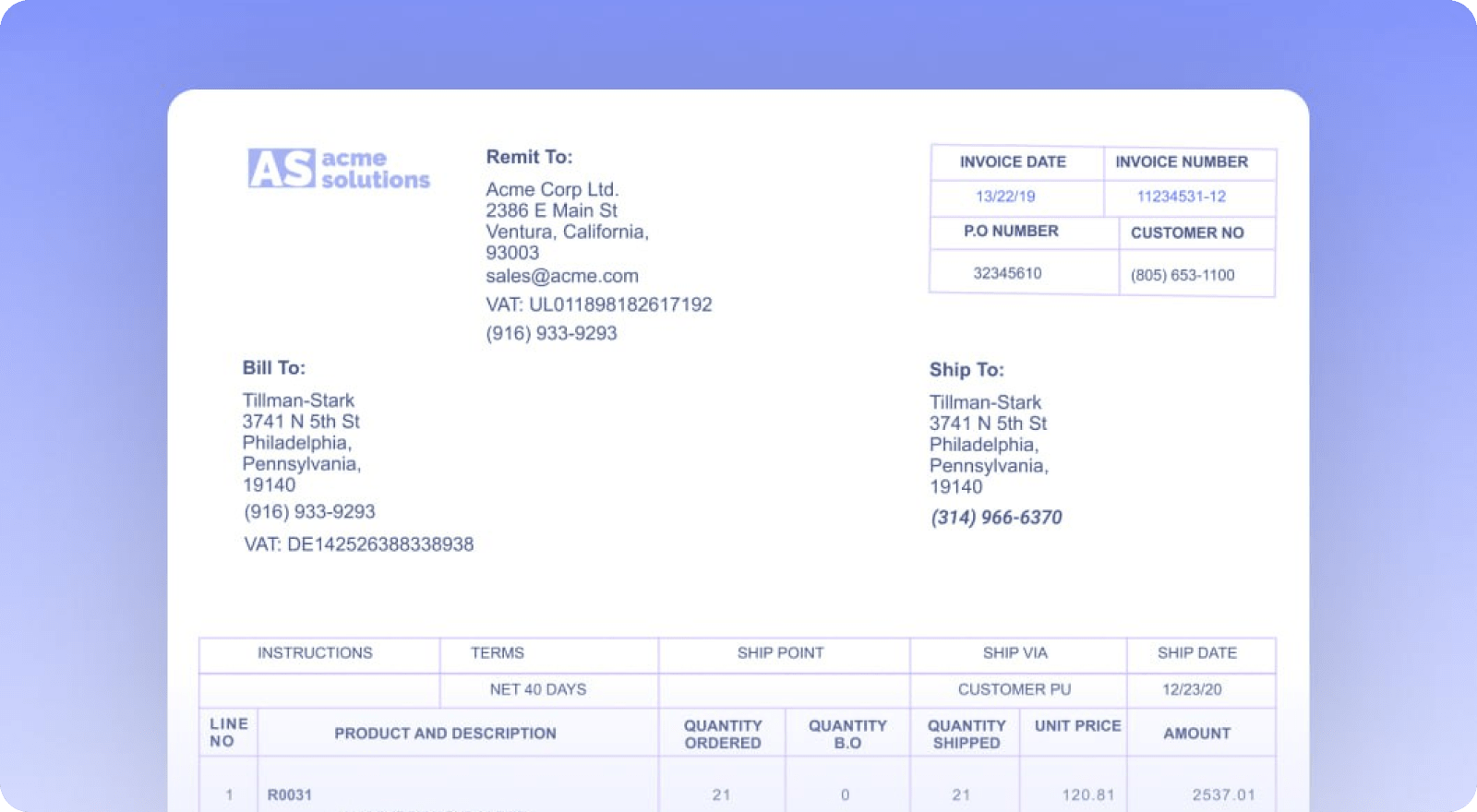

3. Nanonets

Nanonets offers a comprehensive AP automation solution that combines AI-based data capture, intelligent validation, and automated approval workflows. Its self-learning AI models continuously improve accuracy, enabling touchless invoice processing over time. Nanonets provides real-time analytics, ensuring regulatory compliance and reducing operational costs.

Nanonets promo illustration (credits: nanonets.com)

Pros

- Can process a wide range of document types

- Supports more than 40 languages

- 24/7 customer support

- Build custom models

Cons

- Difficulties creating platform parsing rules

- No mobile scanner

- For more complex business needs, users note that the Nanonets model takes some effort to train

Pricing

€499/month for one document model

4. Docsumo

Docsumo is a leading AI-powered AP automation platform that leverages advanced OCR and machine learning to accurately extract data from invoices in any format. Its intelligent data capture capabilities handle complex invoices with high accuracy, reducing manual effort. Users can also convert the extracted data into different formats such as excel/json/csv/txt and feed into their database or any third party software.

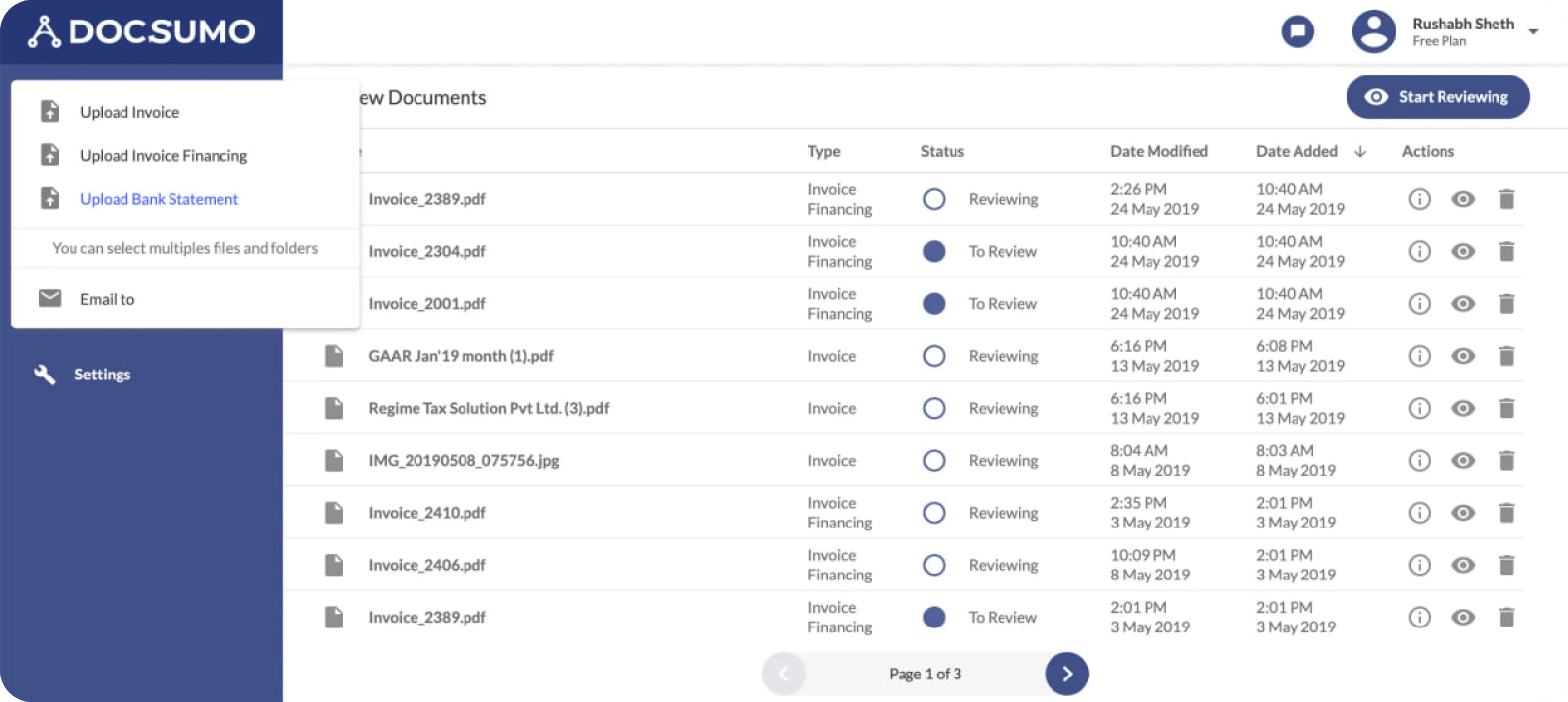

Docsumo dashboard: document upload options

Pros

- Bank statement data extraction API

- Document conversion capabilities from PDF into Excel, CSV, or JSON

- Key-value pair extraction and line item extraction

- Easy-to-use interface

Cons

- Lack of documentation and onboarding support

- Limited document support

Pricing

€500+/month

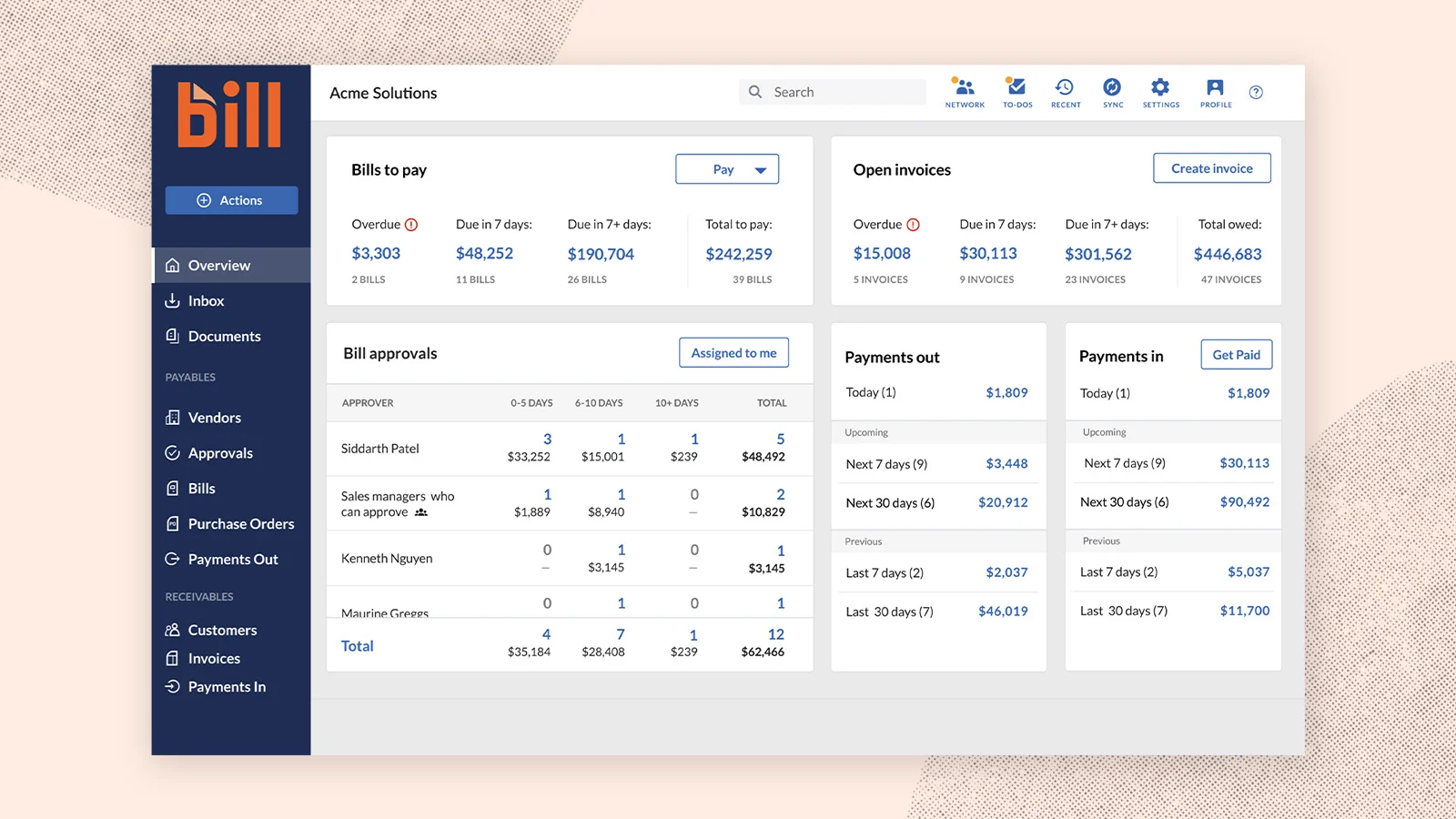

5. Bill

Bill is an accounts payable solution for SMBs to control payables, receivables, expenses, and all corporate expenses. It allows businesses to streamline scattered AP processes into a single platform and gain more control over their finances.

Bill promo illustration (credits: bill.com)

Pros

- One-click swift payments

- Minimum training required

- Easy-to-use mobile app

Cons

- Customer support is difficult to initiate, slow, and unresponsive

- Frequent changes in the interface create confusion for users

Pricing

- Corporate: $79 user/month

- Enterprise: Custom pricing

How to Automate Your Accounts Payable Process

To automate your accounts payable process, start by selecting the right software that aligns with your business needs. For small businesses and startups, it’s crucial to choose small business accounts payable software that is designed for small businesses. Look for cloud-based accounts payable solutions that integrate seamlessly with popular accounting software like QuickBooks. These AP automation tools simplify accounts payable workflows, reducing the time and effort spent on manual data entry.

In 2025, the best AP automation software provides end-to-end accounts payable solutions, offering features like real-time invoice processing and automatic approval workflows. These accounts payable automation platforms allow businesses to streamline their payable process, enhance accuracy, and ensure faster payments.

Comparison of payable software solutions in 2025 will help you find the top accounts payable automation tool suited for your business. Many of these solutions are powerful enough to handle complex AP tasks and seamlessly integrate accounts payable with your existing accounting system. With the benefits of AP automation, you can optimize your accounts payable system, reduce errors, and gain better control over your cash flow.

Automate document processing with TurboDoc

Recognize invoices, contracts, and forms in seconds. No manual work or errors.

Try for free!

❓ FAQ

Which software is commonly used for accounts payable automation?

There are several accounts payable software solutions available, but some of the best accounts payable software platforms include AP automation software that integrates seamlessly with accounting systems like QuickBooks and other ERP systems. These software platforms are designed to optimize the accounts payable workflow, allowing businesses to automate tasks such as invoice processing, payment approval, and bank account reconciliation. Popular choices also offer AP solutions tailored for small businesses and larger enterprises.

How can I automate accounts payable?

To automate your accounts payable process, start by selecting the right AP automation software that suits your business needs. These solutions help automate tasks such as invoice approvals, payment scheduling, and integration with accounting systems like QuickBooks or Netsuite. Many software platforms also support best practices for automating workflows, ensuring accuracy and reducing manual errors in your accounts payable workflow. By implementing an AP solution, your finance team can save time and improve efficiency.

Does TurboDoc have AP automation?

Yes, TurboDoc offers AP automation software that helps businesses streamline their accounts payable process. With this tool, you can automate invoice data extraction, approval workflows, and integrate with accounting systems. TurboDoc’s accounts payable automation solution is designed to improve accuracy, reduce errors, and support the finance team in managing the payable process more efficiently.

How much does AP automation software cost?

The cost of AP automation software varies depending on the solution and the size of your business. For small businesses, there are affordable software for small business options that offer essential automation features. Pricing typically depends on the features, number of users, and integration needs, such as with bank accounts or accounting systems like QuickBooks. To get the right accounts payable solution for your needs, it’s best to compare pricing across different software platforms to find a solution that fits your budget and workflow.