What is accounts payable automation?

Accounts payable (AP) automation is a type of technology that streamlines and enhances traditional AP operations. The software automates several key functions such as capturing supplier name, total amount, taxes, due date, supplier payment details, invoice number, invoice date and others and routing them for approval. This proactive approach reduces errors and increases efficiency for smoother financial management.

How to choose AP automation solutions effectively

-

Pricing and Value: Evaluate all costs involved, including setup fees and ongoing subscription charges and ensure the pricing fits your budget and offers good value for the features provided.

-

Integration Options: The solution should integrate with your existing ERP/CRM/SRM or accounting systems, enabling a truly seamless invoice processing workflow from start to finish. Plus, mail integration can help with a smooth transition to automated invoice processing.

-

Security and Compliance: Ensure the solution has robust security features to protect sensitive financial data. Your confidential data should be handled securely, protecting against unauthorized access.

-

Scalability and Customization: Look for a solution that can scale to handle growing invoice volumes and can adapt to your unique business processes. The ability to configure workflows, approval hierarchies, and reporting is key. Also, flexible pricing is important to ensure flexibility and efficiency at every stage.

-

Data Extraction Accuracy: Modern Optical Character Recognition, combined with machine learning, can work with more complex invoices or low-quality images. The software is capable of successfully extracting data from invoices, such as vendor name, invoice number, dates, line items, and totals.

Top 5 AP automation tools

1. TurboDoc

TurboDoc is an optical character recognition tool offering automated invoice and receipt processing using AI. By using our tool, you can save time and focus more on other areas critical to the business. TurboDoc is powered by an advanced AI model trained on a large corpus of documents, ensuring high accuracy.

TurboDoc’s dashboard: invoices are being imported automatically from Gmail mailbox

Benefits of choosing TurboDoc for AP automation

TurboDoc simplifies AP automation with its rapid and precise data extraction. Invoices come in all kinds of different formats and processing each invoice requires full-time departments. By integrating our solution, businesses can reclaim valuable time and eliminate the risks associated with manual processing errors.

Easily integrate TurboDoc into your existing workflow through Gmail to automate accounts payable

TurboDoc can provide a smooth transition to automated AP processing through Gmail integration, delivering scalability and adaptability as your business evolves. We are currently working on compatibility options using accounting software APIs. Our product will seamlessly integrate into your current accounting processes and ERP/CRM/SRM systems. TurboDoc will boost accuracy, efficiency, and productivity, making it a valuable tool for businesses looking to optimize their financial operations.

TurboDoc prioritizes data security and compliance

Our platform protects your data from unauthorized access or breaches. You can trust that your confidential information is handled with the utmost care and in compliance with relevant regulations by choosing TurboDoc. You can find more details about it in our Privacy Policy section.

Pricing

- Simple – $6/month

- Pro – $30/month

- Self-hosting – Ad-hoc

2. Xero

Xero is a cloud-based accounting software that offers robust AP automation capabilities, including invoice data capture, approval workflows, and seamless integration with payment systems. Users can track their financial metrics, perform cash flow analysis, file GST returns, backup their original documents electronically, and do much more when it comes to running their business using its various tools.

Xero dashboard: invoice editing feature

Pros

- Simplistic UI provides a clear financial view

- Automated daily bank feeds

- Interactive credit control to manage sales invoices

Cons

- Limited expense claims, projects, as-well-as multi-currency support

- It does not offer a built-in ‘Debtor Chasing’ function

- Some features are complicated to understand and require experience

Pricing

- Early – $11 per month

- Growing – $32 per month

- Established – $62 per month

3. Nanonets

Nanonets offers a comprehensive AP automation solution that combines AI-based data capture, intelligent validation, and automated approval workflows. Its self-learning AI models continuously improve accuracy, enabling touchless invoice processing over time. Nanonets provides real-time analytics, ensuring regulatory compliance and reducing operational costs.

Nanonets promo illustration (credits: nanonets.com)

Pros

- Can process a wide range of document types

- Supports more than 40 languages

- 24/7 customer support

- Build custom models

Cons

- Difficulties creating platform parsing rules

- No mobile scanner

- For more complex business needs, users note that the Nanonets model takes some effort to train

Pricing

€499/month for one document model

4. Docsumo

Docsumo is a leading AI-powered AP automation platform that leverages advanced OCR and machine learning to accurately extract data from invoices in any format. Its intelligent data capture capabilities handle complex invoices with high accuracy, reducing manual effort. Users can also convert the extracted data into different formats such as excel/json/csv/txt and feed into their database or any third party software.

Docsumo dashboard: document upload options

Pros

- Bank statement data extraction API

- Document conversion capabilities from PDF into Excel, CSV, or JSON

- Key-value pair extraction and line item extraction

- Easy-to-use interface

Cons

- Lack of documentation and onboarding support

- Limited document support

Pricing

€500+/month

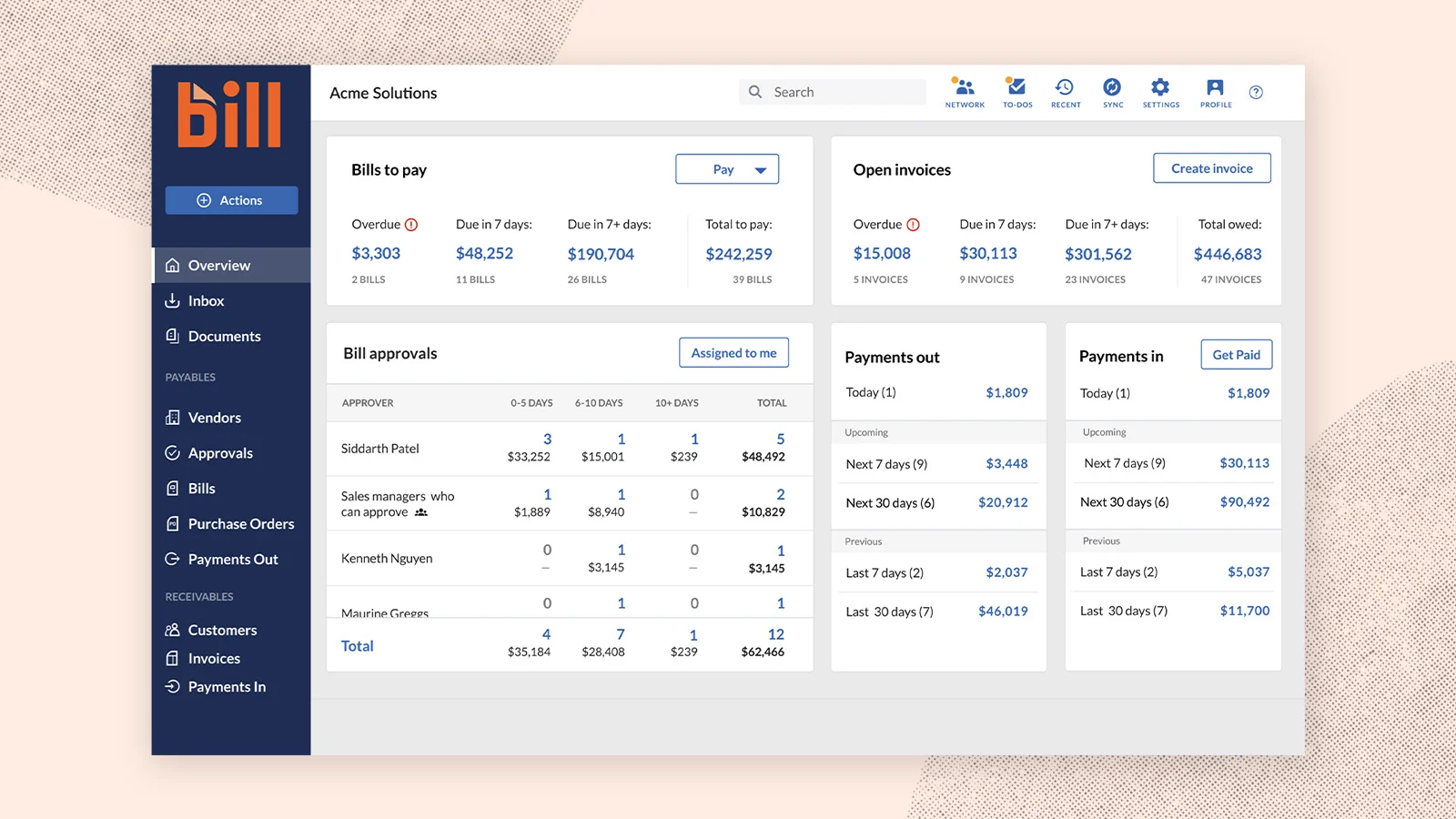

5. Bill

Bill is an accounts payable solution for SMBs to control payables, receivables, expenses, and all corporate expenses. It allows businesses to streamline scattered AP processes into a single platform and gain more control over their finances.

Bill promo illustration (credits: bill.com)

Pros

- One-click swift payments

- Minimum training required

- Easy-to-use mobile app

Cons

- Customer support is difficult to initiate, slow, and unresponsive

- Frequent changes in the interface create confusion for users

Pricing

- Corporate: $79 user/month

- Enterprise: Custom pricing