In today’s globalized business environment, efficient invoice management is crucial for companies of all sizes. With an increasing number of businesses operating internationally, tracking payments and managing invoices across borders has become more complex than ever. Understanding how to track wire transfers is essential, as wire transfers remain one of the most reliable methods for settling international invoices and ensuring smooth business operations.

Automate document processing with TurboDoc

Recognize invoices, contracts, and forms in seconds. No manual work or errors.

Try for free!

Understanding Wire Transfers and Their Importance

Before diving into wire transfer tracking, it’s crucial to understand what sets wire transfers apart from other payment methods. While both wire transfers and bank transfers move money between accounts, wire transfers offer distinct advantages. The key difference between wire transfer vs bank transfer lies in their processing systems, security features, and tracking capabilities.

Types of Wire Transfers and Their Processing Times

Wire transfer time frame can vary significantly depending on several factors:

- Domestic wire transfer duration: Typically processed within the same business day

- International wire transfer time: Usually takes 1-5 business days

- Same day wire transfer: Available for urgent domestic transfers, though additional fees may apply

- Bank transfer time: Can range from 1-3 business days for domestic transfers to 3-7 days for international ones

How to Track a Wire Transfer: Comprehensive Guide

Understanding how to check status of wire transfer transactions is crucial for both senders and recipients. Here’s a detailed breakdown of the tracking process:

1. Essential Information for Wire Transfer Tracking

Before initiating a trace, gather these crucial details:

- Wire tracking number (provided by your bank)

- Transaction reference number

- Exact amount transferred

- Sender and recipient bank information

- Date and time of transfer

- Purpose of payment

2. Methods for Checking Wire Transfer Status

Multiple options exist for monitoring your transfer:

Online Banking Platforms

- Log into your bank’s online portal

- Navigate to the wire transfer status section

- Enter your wire tracking number

- Review real-time updates on your transfer

Direct Bank Contact

- Call your bank’s wire department

- Provide your reference numbers

- Request detailed status updates

- Inquire about any wire transfer delays

SWIFT Tracking System

- Use your SWIFT tracking number

- Monitor international transfers

- Track through multiple banking systems

Automate document processing with TurboDoc

Recognize invoices, contracts, and forms in seconds. No manual work or errors.

Try for free!

Wire Transfer Processing Time and Potential Delays

Understanding wire transfer processing time helps set realistic expectations. Several factors can impact the duration:

Standard Processing Times

- Domestic transfers: Usually same-day or next-day delivery

- International transfers: 1-5 business days

- Express services: Can be completed within hours (with additional fees)

Common Causes of Wire Transfer Delays

Several factors can affect how to wire money successfully:

- Bank processing schedules and cut-off times

- International time zones and business hours

- Security verification requirements

- Incomplete or incorrect information

- Intermediary bank processing

- Currency conversion procedures

- Compliance checks and regulations

Wire Transfer Fees and Tracking Costs

Understanding the cost structure helps in planning transfers effectively:

Standard Wire Transfer Fees

- Domestic sending: $25-35 typically

- International sending: $45-50 on average

- Receiving fees: $15-20 for most banks

- Additional correspondent bank fees may apply

Tracking-Related Costs

- Basic tracking: Usually included in transfer fee

- Detailed investigations: May incur additional charges

- Express tracking services: Premium fees may apply

Best Practices for Successful Wire Transfers

To ensure smooth processing and easy tracking:

Before Sending

- Verify all recipient information

- Confirm wire transfer fees

- Check cut-off times

- Prepare supporting documentation

During Processing

- Save your wire tracking number

- Monitor your account

- Keep communication channels open

- Document all correspondence

After Transfer

- Confirm receipt with beneficiary

- Retain all transaction records

- Monitor for any return fees

- Reconcile with invoice records

Automate document processing with TurboDoc

Recognize invoices, contracts, and forms in seconds. No manual work or errors.

Try for free!

International Wire Transfer Considerations

When dealing with international transfers, additional factors come into play:

Currency Considerations

- Exchange rate fluctuations

- Conversion timing

- International banking fees

- Local regulatory requirements

Compliance Requirements

- Anti-money laundering checks

- Know Your Customer (KYC) verification

- International banking regulations

- Documentation requirements

Troubleshooting Wire Transfer Issues

When problems arise, follow these steps:

- Contact your sending bank immediately

- Provide all relevant tracking information

- Request a wire transfer trace

- Document all communication

- Consider recall options if necessary

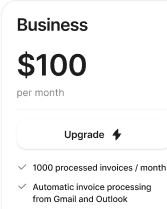

Simplify Your Invoice and Payment Tracking with TurboDoc

Managing multiple wire transfers for international invoice payments can be complex and time-consuming. Our platform helps businesses maintain clear visibility over their international payments and invoices in one unified system. Whether you’re sending occasional wire transfers or managing multiple international payments daily, TurboDoc simplifies the process.

Ready to transform how you track your wire transfers and manage your invoices? Try TurboDoc today and experience seamless payment tracking and invoice management in one powerful platform.

❓ Wire Transfer Tracking FAQs

Is there a way to track a wire transfer?

Yes. You can track a wire transfer using the confirmation number or reference code provided by your bank. This helps you see whether the transfer has been sent, is in progress, or has been completed.

Are wire transfers traceable to a bank account?

Absolutely. Each wire transfer carries identifying details such as sender and recipient bank information, making it fully traceable.

Are international wire transfers tracked?

Yes. International wires are tracked through the SWIFT network, which assigns each transaction a unique reference number.

How do I know when a wire transfer is received?

Your bank or the recipient’s bank usually notifies you when funds are credited. You can also check your account activity online or contact your bank for confirmation.

Can I track a SWIFT transfer?

Yes. A SWIFT transfer can be tracked using the SWIFT MT103 document, which contains a unique reference number that shows the transfer’s journey.

What’s the longest a wire transfer can take?

Domestic transfers often settle the same day or within 24 hours. International wires can take up to 5 business days depending on intermediary banks, time zones, and compliance checks.

Can money get lost in a wire transfer?

It’s rare, but funds can be delayed or misrouted due to incorrect account details or intermediary bank issues. Typically, the money can be traced and recovered.

What are the risks of wire transfers?

Risks include sending funds to the wrong account, fraud or scams, high fees, and limited ability to reverse a payment once it’s sent.

Can a wire transfer be reversed?

Generally no, once a wire transfer is completed. However, if you catch an error early and notify your bank immediately, they may attempt to recall the funds.

Why is my wire transfer taking so long?

Delays can occur due to compliance checks, weekends or holidays, incorrect details, or intermediary banks holding funds for verification.